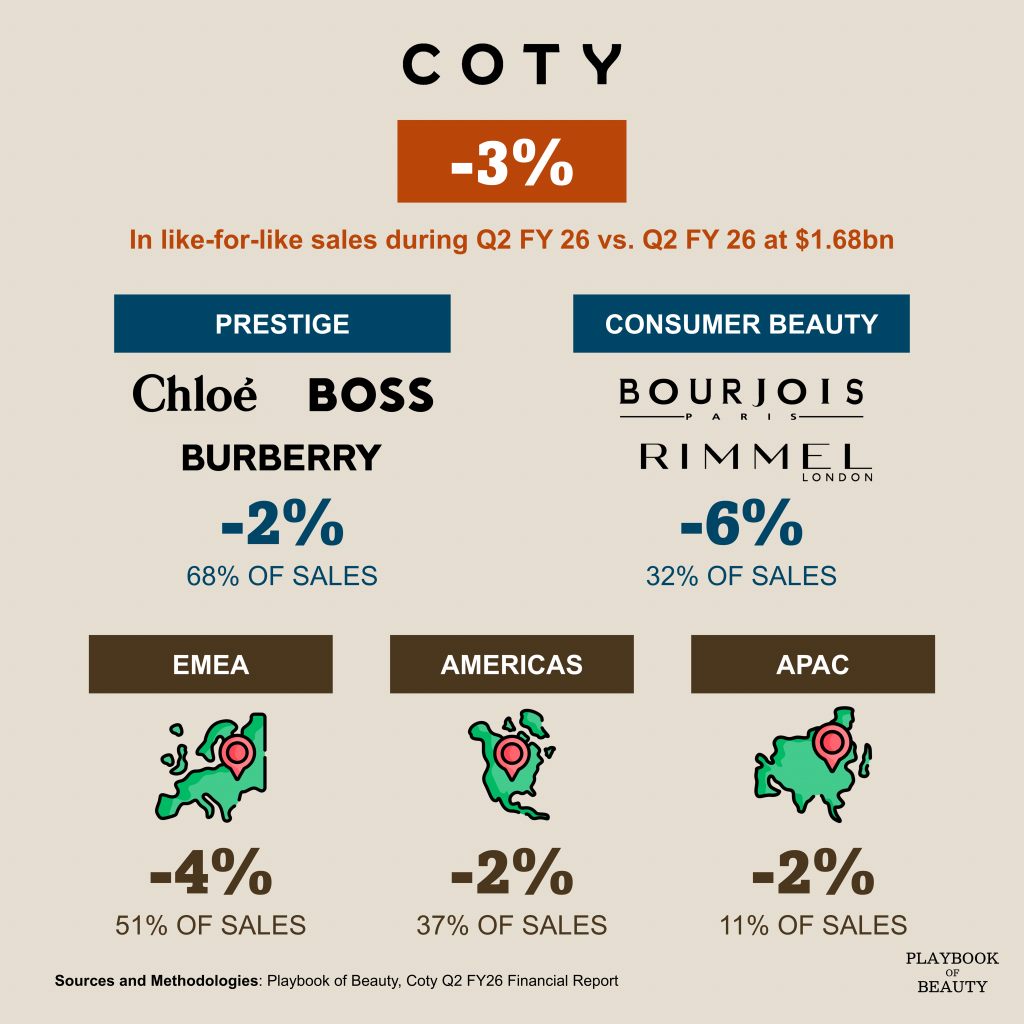

Coty reported Q2 FY26 net revenues of $1,68bn, a modest 1% increase on a reported basis but on a like-for-like basis revenue declined by 3%.

The Prestige division, representing 68% of sales, saw reported revenue increase 2% to $1,1bn, though it declined 2% on an LFL basis. The Consumer Beauty segment, accounting for the remaining 32%, experienced a 2% reported decline to $545.m , with a more pronounced 6% LFL decrease.

Geographically, results were mixed. The Americas region saw a 2% reported revenue decline to $624.5m. EMEA reported a 3% increase to $864.2m, though this turned to a 4% LFL decline. Asia Pacific revenues were $189.9m, a 2% LFL decrease.

Strategically, new leadership has initiated the “Coty. Curated.” framework, aiming for sharper priorities and focused investment. The company also completed the divestiture of its remaining Wella stake, significantly strengthening its balance sheet and reducing leverage to 2.7x.

For Q3, Coty anticipates mid-single-digit LFL revenue decline, citing ongoing pressures in Consumer Beauty and an intensified promotional landscape. The company has withdrawn its full-year EBITDA and cash flow guidance during this leadership transition and strategic review period.