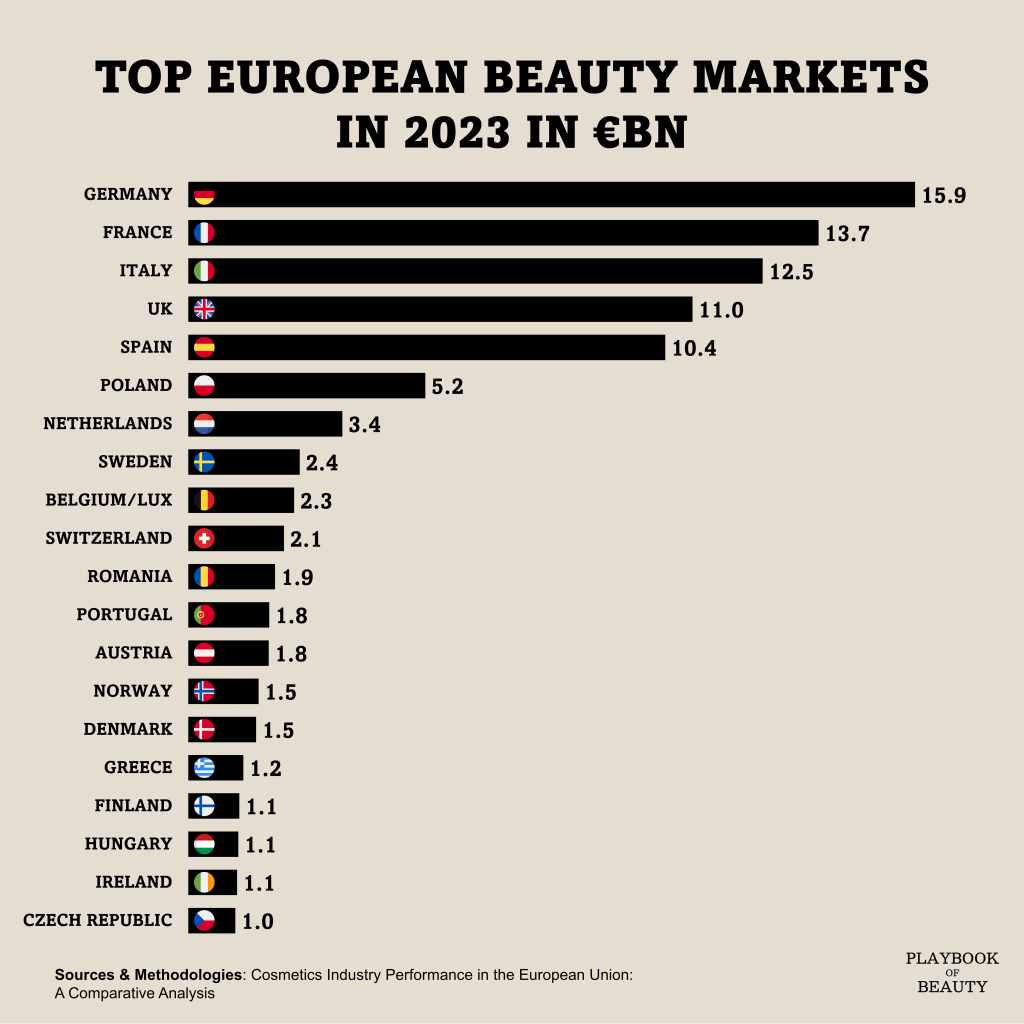

According to data from Cosmetics Europe for 2023, the European domestic market was valued at €95.7bn, securing its position as the world’s second-largest, albeit approximately 8% smaller than the United States. This vast economic engine is led by Germany (€15.9bn), France (€13.7bn), and Italy (€12.5bn). The industry’s footprint is substantial: Oxford Economics reports it employs 3.2 million people and generates €180bn in GDP within the EU.

France and Germany operate as twin pillars, each with a different strength. Germany leads in retail value, supported by high per-capita spending and a dominant drugstore channel, with a consumer preference for science-backed products from local champions like Beiersdorf. France combines a large domestic market with the first global spot in terms of beauty exports. Its ecosystem is notably complete, spanning global luxury groups, specialized manufacturers, and a resilient multi-channel retail network.

Italy, while slightly smaller in consumption, functions as a critical manufacturing and export powerhouse, particularly in color cosmetics and fragrance.

The United Kingdom, though comparatively smaller to its population, is perhaps the most dynamic, with the highest projected growth rate among large Western European nations to 2030. It is structurally skewed toward premium segments and is Europe’s digital leader, with online sales growing by over a third recently, making it a preferred launchpad for international brands.

Spain presents an interesting case, ranking fifth with a market size rivaling the UK’s despite a smaller population and lower GDP per capita, reflecting high per-capita consumption, the highest outside of Switzerland and Nordics countries.

Poland, in sixth position with a €5.2bn market, stands out as the EU’s fastest-growing. With government data suggesting the Polish cosmetic industry experienced a remarkable 16.8% growth rate in 2024.

Success in Europe requires a segmented approach, not a single regional strategy. The market demands simultaneous navigation of Germany’s scientific rigor, France’s industrial-commercial nexus, Italy’s export-oriented supply chain, and the UK’s digital-led premium environment. Meanwhile, high-growth opportunities in Poland and resilient consumption in Spain underscore the need for a multi-speed operational model. Ultimately, Europe’s strength lies in this very complexity, offering complementary hubs for manufacturing, innovation, and commercial validation.