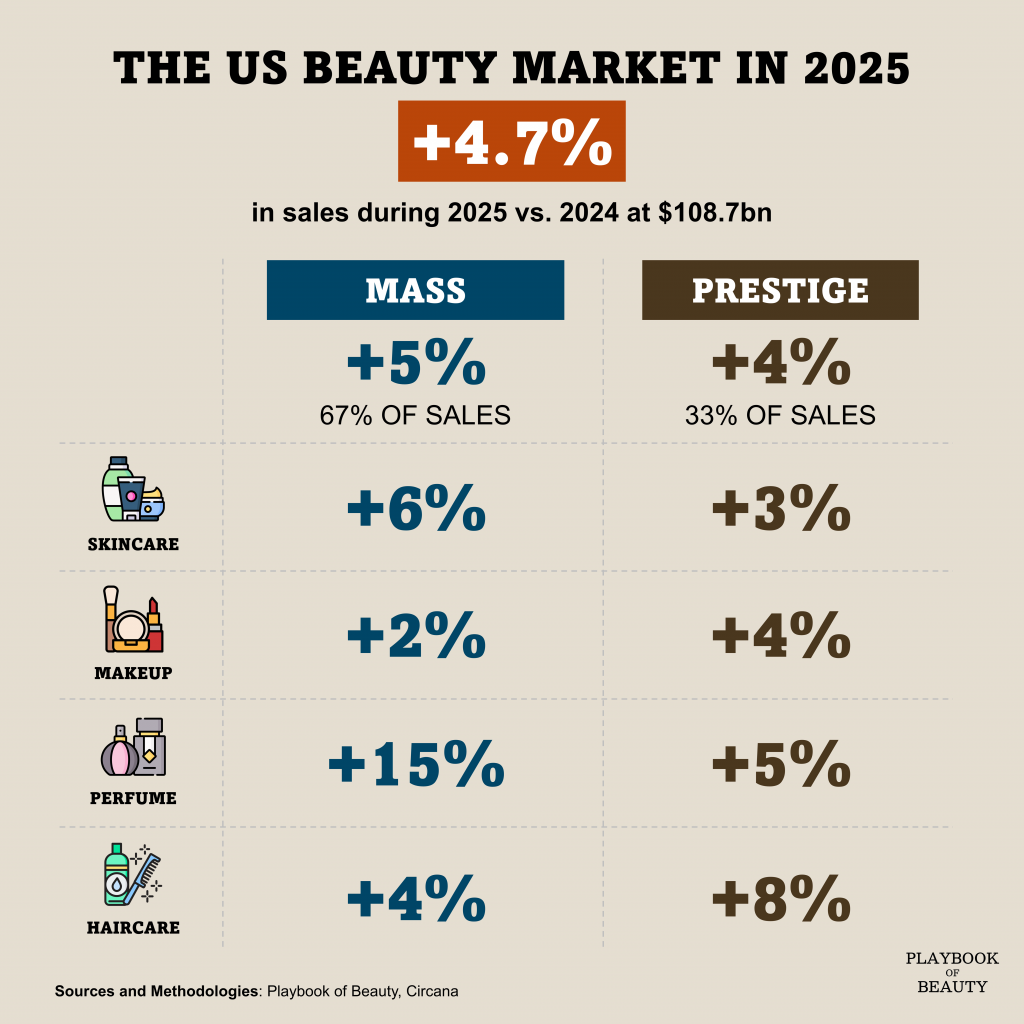

The U.S. beauty industry closed 2025 with notable resilience, delivering growth amid persistent economic pressures. According to Circana, the total market grew 4.7% with prestige retail sales rising 4% to $36 billion and mass retail increasing 5% to $72.7 billion. Beyond headline growth, there is a strategic evolution in value happening. Mass growth, driven by items like shampoo-conditioner combo packs, prioritizes volume and utility. Prestige growth, however, is anchored in perceived efficacy and hybrid benefits. This divergence pressures mid-tier brands, creating a sharper market polarization.

Makeup retained its position as the largest prestige category, growing 4%. Its expansion was anchored by the “skinification” trend, where hybrid formats blend color with skincare benefits—a shift exemplified by brands like Dior with its Lip Glow oil. Top-performing segments included lip liner and lip treatments, a trend mirrored in the mass market through brands such as e.l.f. Cosmetics.

Prestige hair care emerged as the fastest-growing category by dollar sales. This was propelled by treatments and a standout scalp care segment, which saw its third consecutive year of double-digit growth, highlighting the “medicalization” of the category with leaders like K18.

Prestige skincare posted a 3% dollar increase and was the fastest-growing category by units sold. It rebounded strongly in the second half, outpacing makeup and fragrance during the holiday period, reinforcing its non-discretionary status in consumer regimens.

Fragrance experienced another robust year across both retail tiers. Mass fragrance, though the smallest category, grew an impressive 15% in dollars, fueled by accessible luxury and social media-driven discovery. Prestige fragrance grew 5%, maintaining its position as the second-largest prestige segment. The market showed signs of normalization after years of explosive growth, with mini sizes and premium concentrations maintaining influence as seen with brands like Sol de Janeiro.

Brands winning in this market are those delivering tangible innovation and multifunctional benefits. I reckon this is no longer about impulsive indulgence, but a calculated consumption where every purchase must justify itself through efficacy or experience.