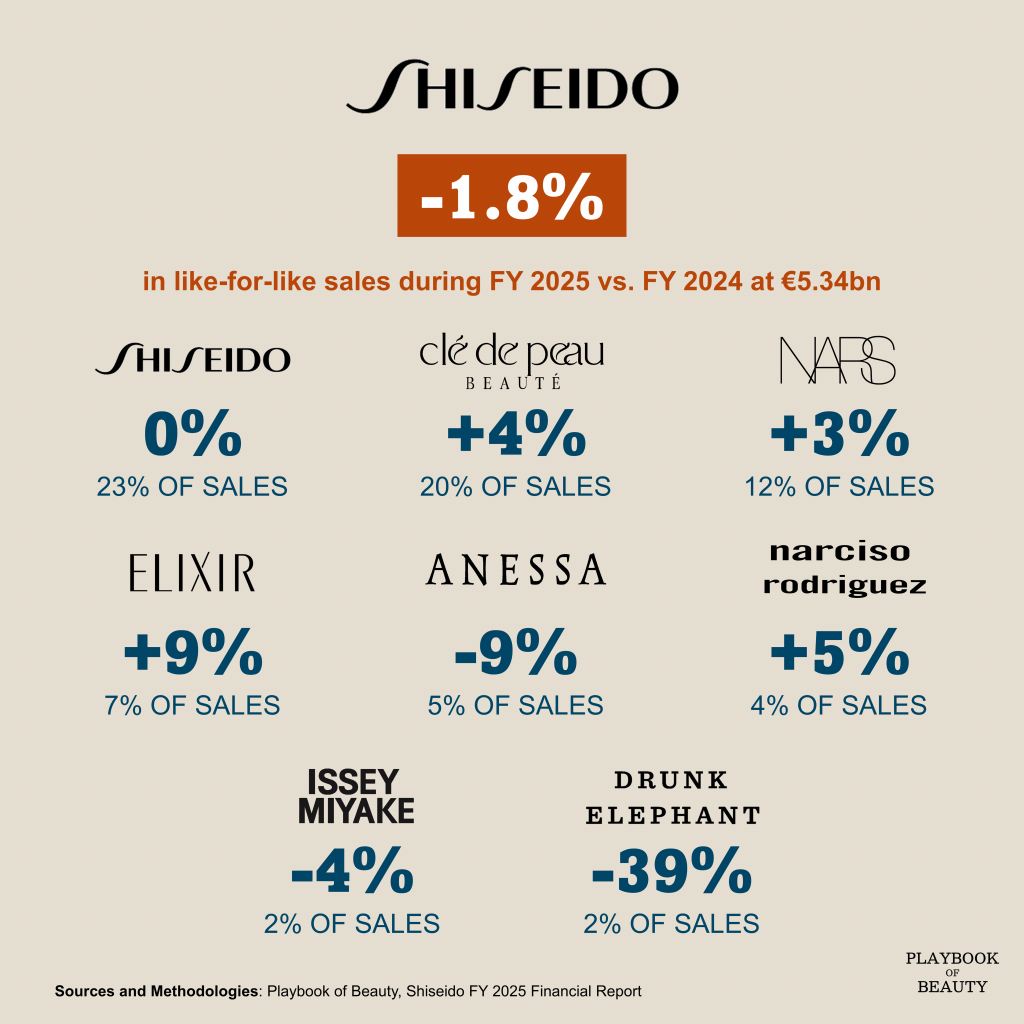

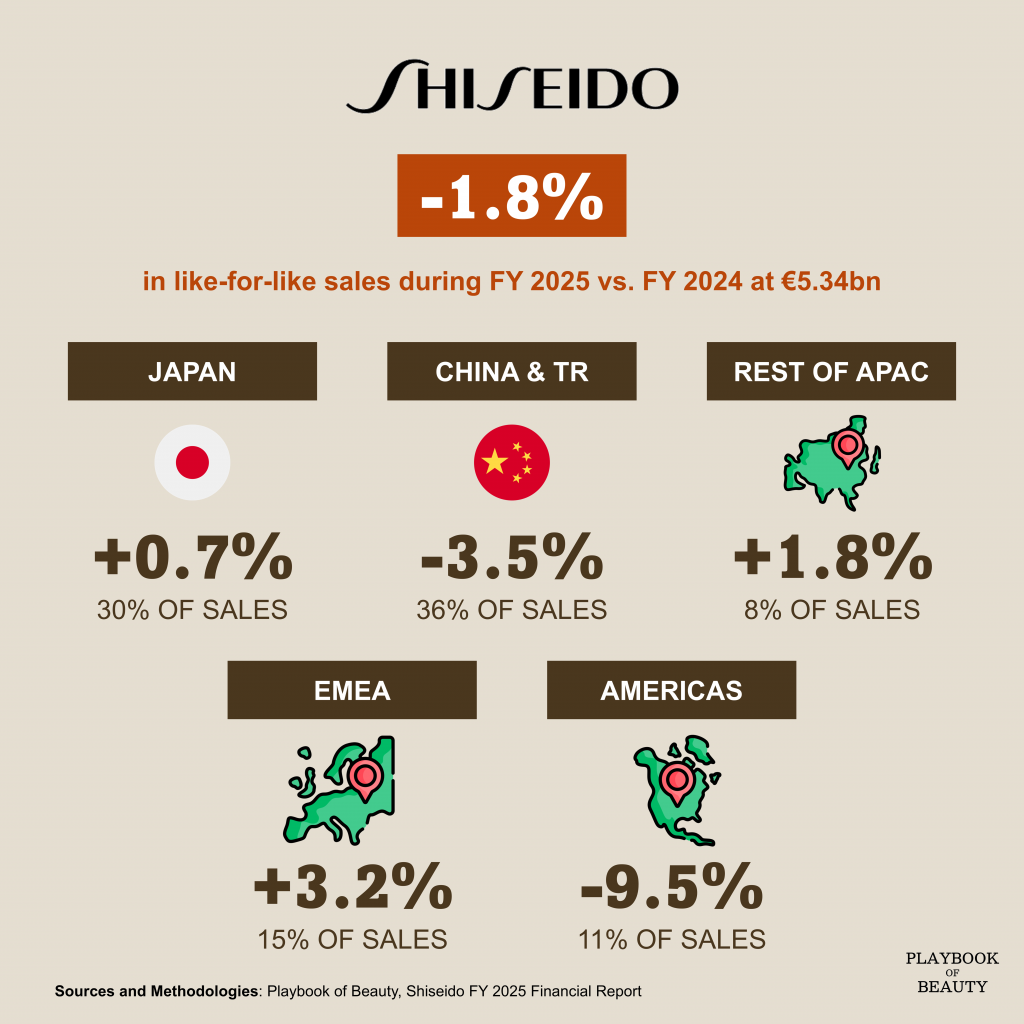

Shiseido closed 2025 with like-for-like sales down 1.8% to €5.34bn. Core operating profit rose 22.4% to €244.9m, beating its initial forecast. Free cash flow raised to €365.8m thanks to working capital improvements. However a €257.4m goodwill impairment in the Americas, triggered by sustained profitability declines, pushed the group to a net loss of €223.7m.

Japan expanded 0.7% like-for-like. SHISEIDO and ELIXIR new product launches drove local share gains. Inbound eased as price convergence with China, fuelled by intense local competition, narrowed the arbitrage window for tourists.

China & Travel Retail contracted 3.5% like-for-like. Clé de Peau Beauté and NARS outperformed during Double 11. Travel retail remained under pressure from cautious Chinese tourist spending.

Asia Pacific grew 1.8% like-for-like. Thailand and South Korea led, with Clé de Peau Beauté and ELIXIR as primary engines.

Americas declined 9.5% like-for-like. Drunk Elephant continued to lose ground; NARS faced shipping-timing comparators. SHISEIDO and Clé de Peau Beauté delivered revenue growth but could not offset the broader weakness.

EMEA gained 3.2% like-for-like. Fragrance labels Zadig&Voltaire and Narciso Rodriguez fuelled growth on new launches. Drunk Elephant remained a headwind.

For 2026, Shiseido forecasts 3% like-for-like net sales growth to €5.45bn. Core operating profit is targeted at €379.5m, a 55% increase. The Americas are expected to return to growth while China & Travel Retail are projected to decline low-single digit.