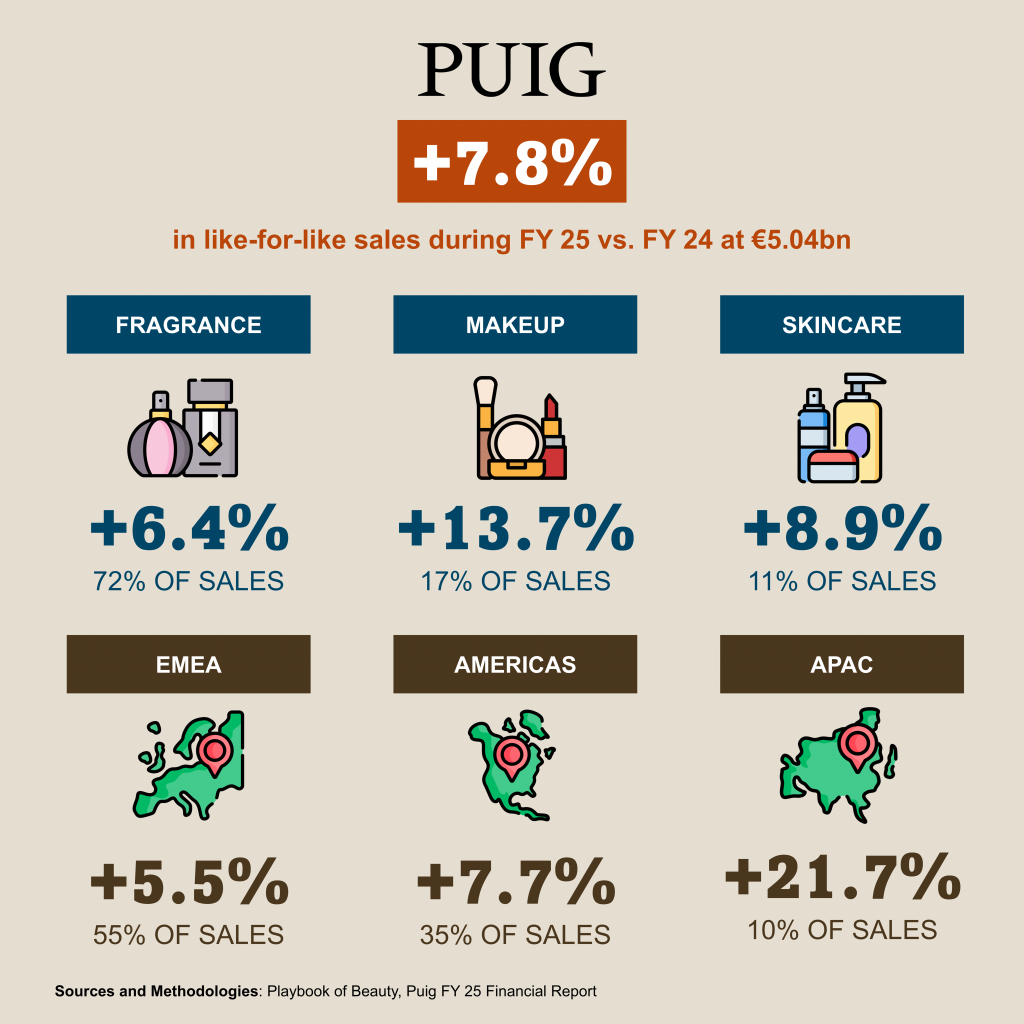

Puig reported full-year sales of €5.04bn for 2025, crossing the five-billion-euro threshold for the first time and growing 7.8% like-for-like. The company more than tripled its 2020 revenue at the end of the five-year plan launched in 2021. Net profit rose 11.9% to €594m , helped by the absence of the IPO-related costs that weighed on 2024 results. Fourth-quarter sales climbed 6.2% in reported terms to €1.45bn, with like-for-like growth reaching 9.8%.

Makeup was the primary driver, with the segment posting a 13.7% like-for-like increase for the year to €845m and 26.5% like-for-like increase in Q4. Charlotte Tilbury delivered strong performance, maintaining its number-one prestige makeup ranking in the UK and third place in the US. The brand also gained distribution through Amazon in the US and entered Mexico.

Skincare followed with €551m in sales, up 8.9% like-for-like, supported by double-digit growth at Uriage and Tilbury’s skincare line.

Fragrance and fashion, which still account for 72% of revenue, grew 3.8% to €3.65bn with Puig estimating its global fragrance market share at 11.1%.

Geographically, EMEA contributed 55% of sales, the Americas 35% and Asia-Pacific 10%. The APAC region posted the strongest organic growth at 21.7% percent, while currency movements clipped 2.6 percent from overall performance, particularly the dollar and emerging market currencies.

Looking to 2026, Puig expects fragrance market growth to normalize but remains confident it will continue to outpace the broader premium beauty sector.