New data from Pattern®, the leading ecommerce accelerator, provides a clear view of the brands that commanded consumer attention during Amazon’s October 2025 Prime Day events in the US and UK. My analysis of top branded keyword searches reveals notable geographic and strategic divides.

In the US, searches were dominated by American and South Korean brands. Skincare was the clear category leader, accounting for 12 of the top 15 branded searches. Medicube emerged as the most searched brand, placing three keywords in the ranking. CeraVe also showed significant strength with two keywords in the ranking, reinforcing its position as Pattern’s reported global top skincare brand on Amazon for Q3 2025. Makeup represented three searches, while haircare and fragrance were absent.

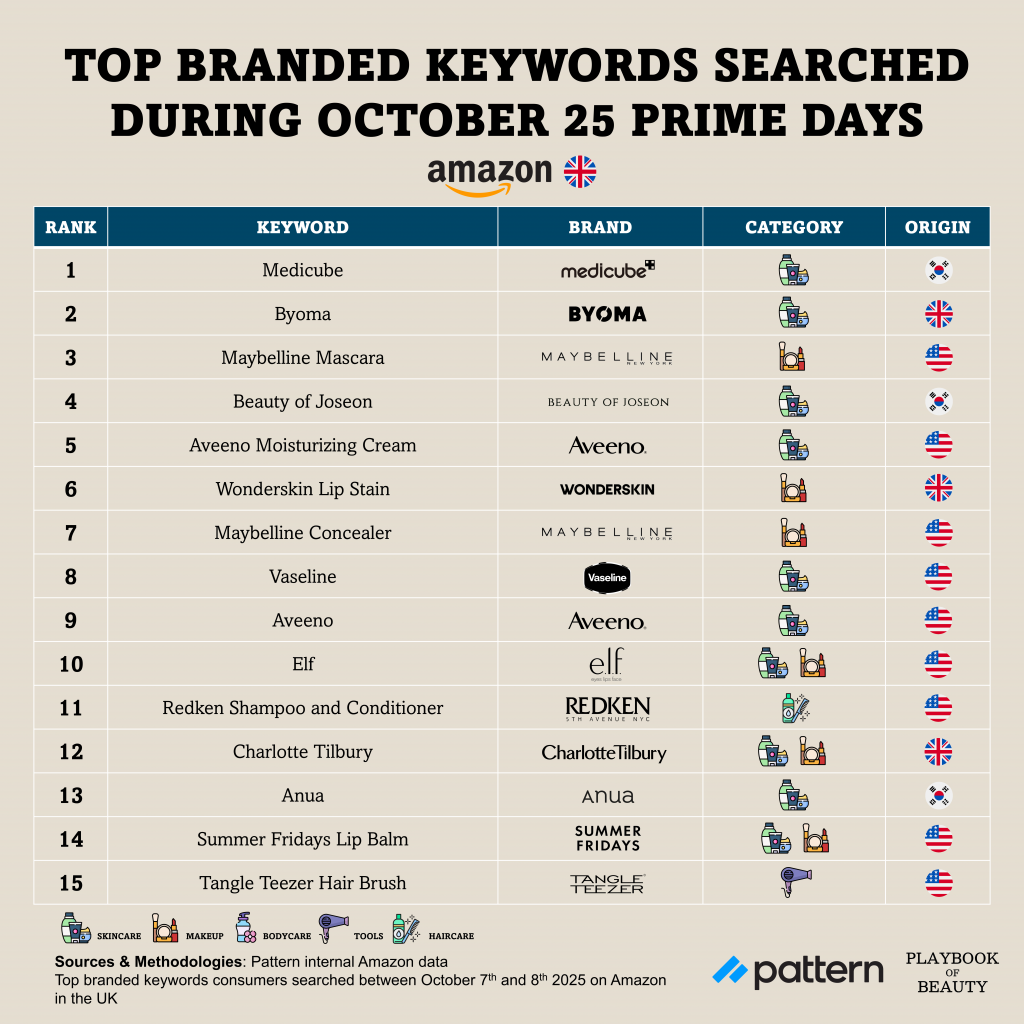

The UK market presented a different picture. While skincare also led with 10 related searches, makeup was more prominent than in the US, claiming 6 spots. These included keywords for Maybelline and British brands Wonderskin and Charlotte Tilbury. In total, 4 of the UK’s top 15 searches were for British brands, with the rest divided between US (8) and Korean (3) labels. Medicube again led overall search volume. A strategic divergence lies in brand ownership: in the UK, 8 of the top branded searches are from brands part of large conglomerates, whereas in the US, CeraVe (owned by L’Oréal) was a notable exception among largely independent brands.

As such, the US appears to be a key battleground for agile, digitally-native brands, particularly in skincare, leveraging Amazon for direct scale. The UK market reflects the stronger hold of established beauty groups with the resources to orchestrate multi-brand, cross-category Prime Day strategies. Furthermore, the continued rise of K-beauty, led by Medicube, demonstrates the global reach of specialized efficacy-driven branding, regardless of market. Finally, the absence of fragrance in both markets suggests it remains less reliant on this discount-driven retail moment.