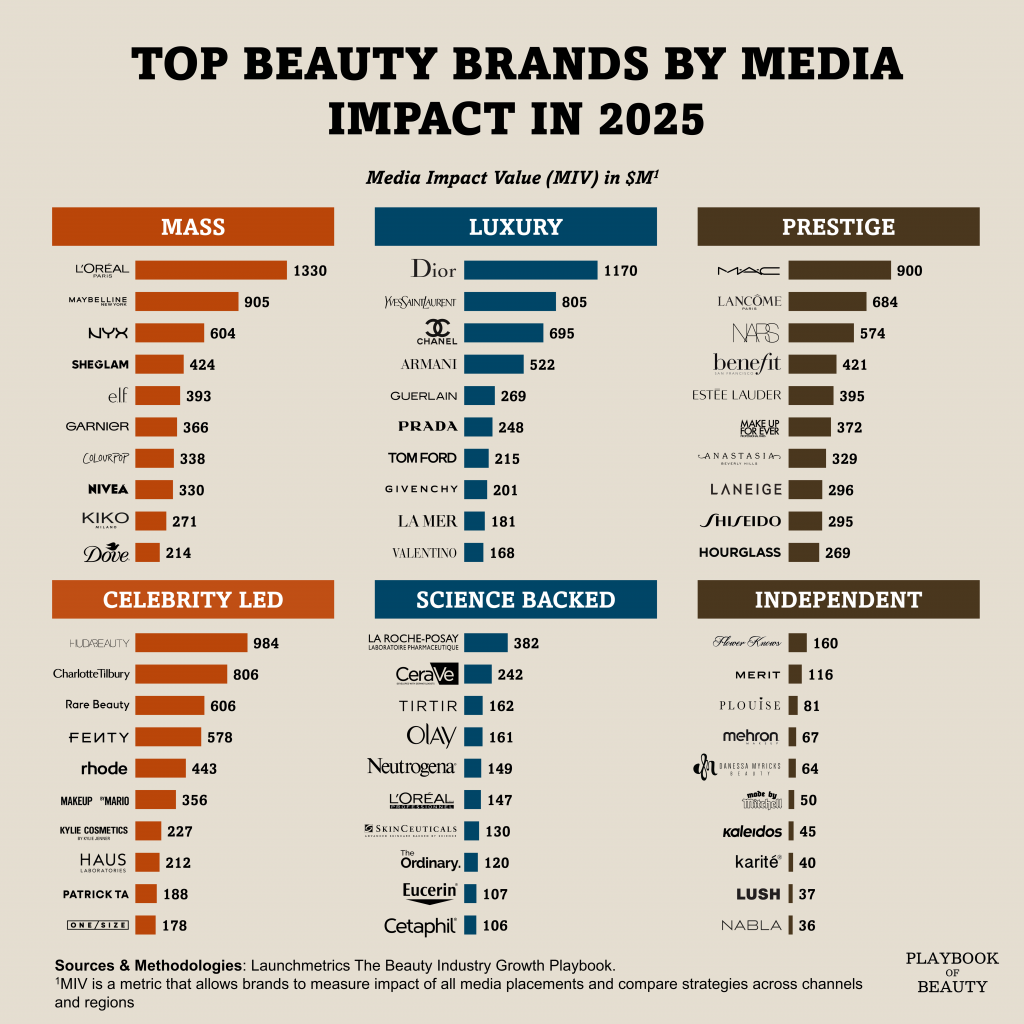

New data from Launchmetrics’ “The Beauty Industry Growth Playbook” provides an overview on beauty brand media performance in 2025. Their Media Impact Value (MIV) metric measures the impact of all media placements, offering a comparative view of strategy effectiveness across channels and regions. Their data reveals a market undergoing distinct strategic shifts.

The mass market segment commands the largest MIV, $5.2bn for its top ten players, and is the second fastest growing at 10%. This growth was notably driven by efficient celebrity activations. Conversely, the prestige category declined by 2%, though Laneige emerged as a stark outlier with 30% growth, powered primarily by a 55% increase in influencer voice. The luxury segment, with a $4.6 billion MIV, saw moderate 1% growth, sustained solely by influencers as other voices contracted.

A significant trend is the maturation of celebrity-led brands. Their aggregate MIV grew 8% as they evolve beyond pure founder visibility. Launchmetrics notes this growth was notably driven by influencers. These brands also possess the industry’s highest owned media MIV. This is strategic: they leverage an initial audience advantage to build engaged brand communities building more resilient business models.

Science-backed brands experienced the highest MIV growth at 13%, fueled by both influencers (+22%) and celebrities (+25%). Finally Independent brands grew 3%, relying heavily on a 39% increase in traditional media voice.

In terms of group visibility, L’Oréal’s dominance is clear. With 13 ranked brands, it generated $6.53bnin MIV double that of second-place LVMH, which had seven brands. L’Oréal also achieved a higher average MIV per brand, $503m to LVMH’s $469m.

Geographically, the U.S. leads in brand count with 28, followed by France with 11. However, French brands generated twice the MIV of their American counterparts. Among independents, British brands lead in number, while only two Korean brands ranked despite the global popularity of Korean skincare.

I reckon impact comes from aligning your media mix with your brand’s inherent equity: be it a founder’s fame, scientific credibility, or precise influencer partnerships. The winners are those who systematically convert audience access into owned community value. Is your brand spending its voice, or investing it?