In 2025, L’Oréal expanded its top line despite currency headwinds and a French exceptional levy that affected net income. Sales reached €44.05bn, up 4% like-for-like. Operating margin went up to 20.2%. Net profit fell 4.4% to €6.13bn, penalised by €250mn in non-recurring taxation.

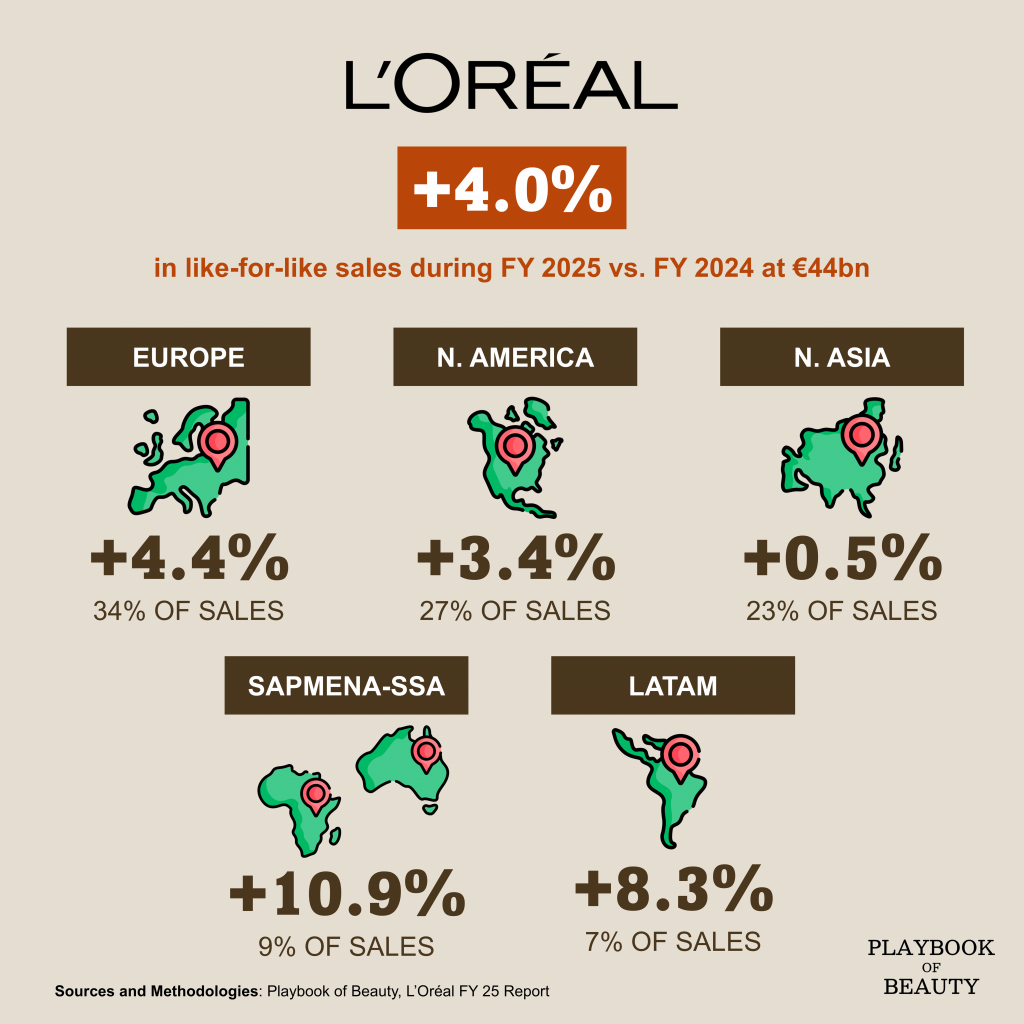

Regional performance diverged sharply. Europe delivered €14.86bn, +4.8% like-for-like, with Luxe capturing the top three spots in female fragrances. North America reported a -0.7% decline, but like-for-like rebounded to +3.4% as market conditions improved in the second half. North Asia remained under pressure: reported sales fell 2.2% to €10.08bn. Excluding travel retail, however, growth accelerated from flat in H1 to +4% in H2. China’s selective market returned to growth, and L’Oréal Paris retained its status as the country’s No 1 beauty brand.

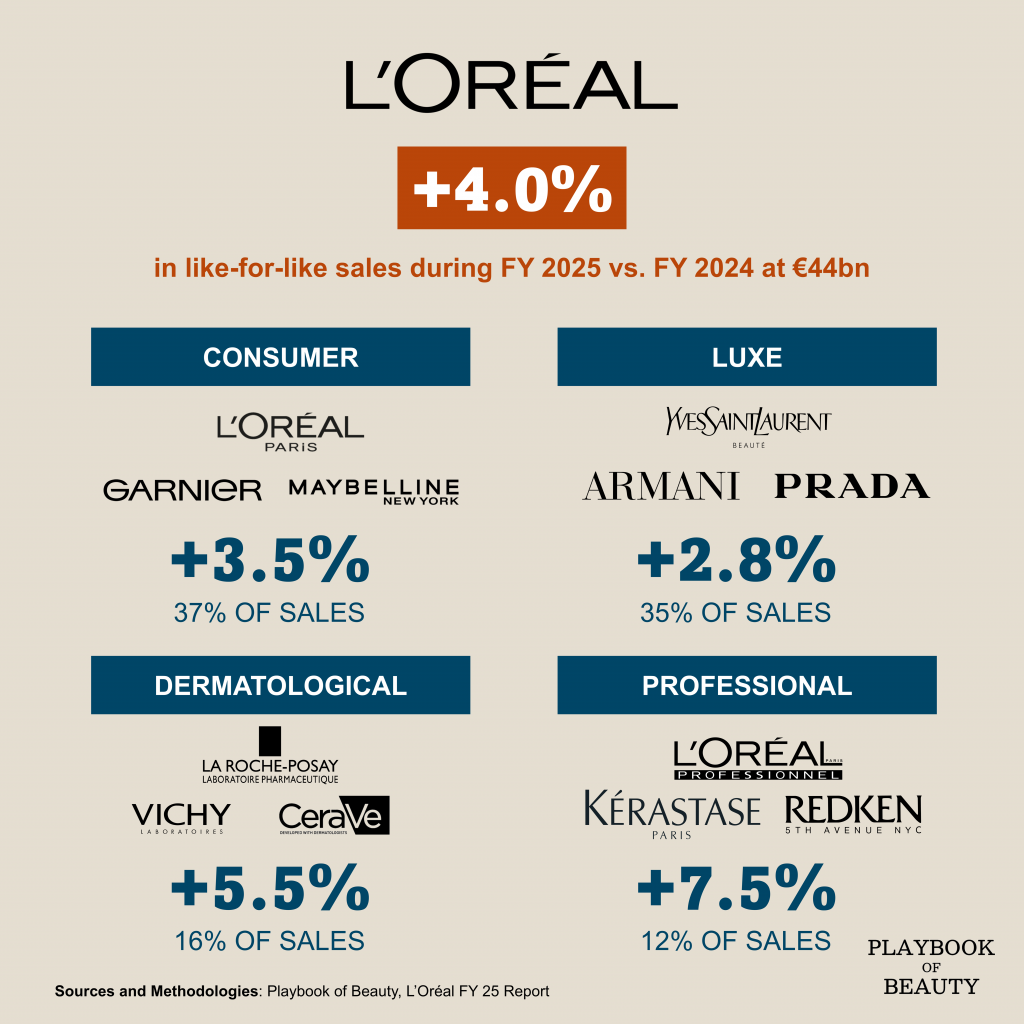

Divisional results underscore where the group is placing its weight. Dermatological Beauty accelerated into double digits in Q4, with SkinCeuticals crossing the €1bn threshold. Professional Products surpassed €5bn for the first time, Kérastase propelled by its Gloss Absolu launch. Consumer Products topped €16bn; L’Oréal Paris remains the world’s largest beauty brand. Luxe was flat reported but +2.8% like-for-like, with fragrance collections growing double digit. Aesop and Maison Margiela were notably exceptional performers.

Hieronimus described 2025 as “historic” for acquisitions. L’Oréal increased its stake in Galderma to 20% and agreed to acquire Kering Beauté for €4bn. It also took a minority position in Jacquemus. The group filed a record 725 patents and spent €1.5bn on technology and AI. “These are not sunk costs,” Hieronimus said. “They open perspectives.” For 2026, the tone is measured: “prudent and humble”, but with conviction that beauty will continue to outpace the global economy.