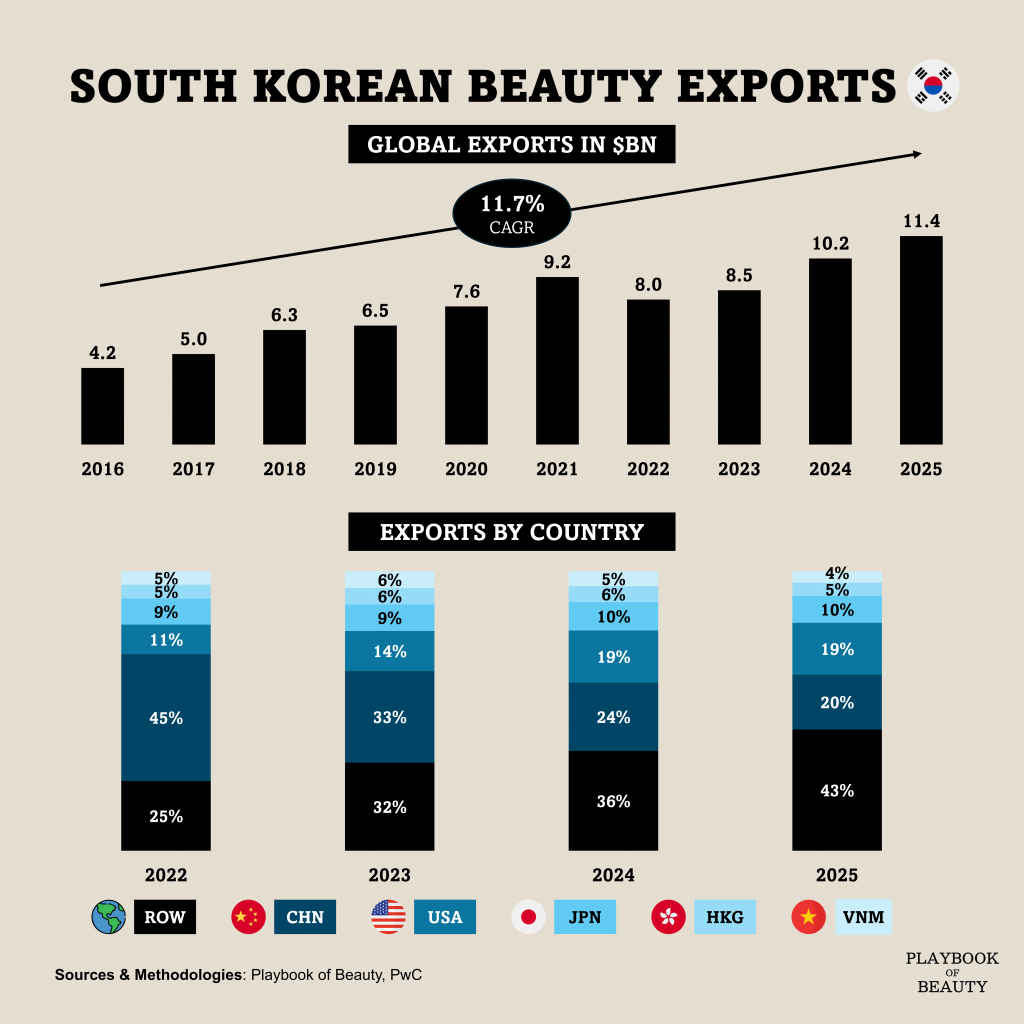

South Korean cosmetics exports surpassed the $11bn milestone in 2025, recording $11.4bn in total shipments. That represents a 12.3% increase year-on-year, with monthly exports hitting record highs throughout the year and September alone exceeding $1.15bn.

But the more significant story lies in the changing geography of demand. Korean beauty products reached 202 countries last year, up from 172 in 2024, signalling a deliberate and successful diversification away from historical reliance on the Chinese market.

The United States has now overtaken China as Korea’s largest cosmetics export destination, importing $2.2bn worth of products. China followed closely at $2bn, with Japan at $1.1bn. While these three remain dominant, their combined share of total exports has contracted. Emerging markets showed explosive growth: shipments to Poland rose 111.7%, while the United Arab Emirates increased by 69.7%. This geographic shift reflects a structural change in how Korean brands approach global expansion.

Rather than concentrating on East Asia, domestic indie brands have driven sales through localized marketing and aggressive online channel penetration. The result is a more balanced portfolio, with Europe, the Middle East, and Latin America contributing meaningfully to growth.

By category, basic skin care products led at $8.54bn nearly 75% of the total exports followed by makeup at $1.51bn. Fragrances posted the strongest category growth at 46.2%, albeit from a smaller base.

Consumption patterns are favourable for K-Beauty. Among MZ generation consumers, efficacy now matters more than brand heritage, a trend accelerating the adoption of Korean skincare routines in North America and Europe via social media. With the US and Europe embracing natural makeup trends, Korean colour cosmetics are positioned for further gains. The question now is whether Korean brands can sustain this momentum as they scale into increasingly diverse regulatory environments.