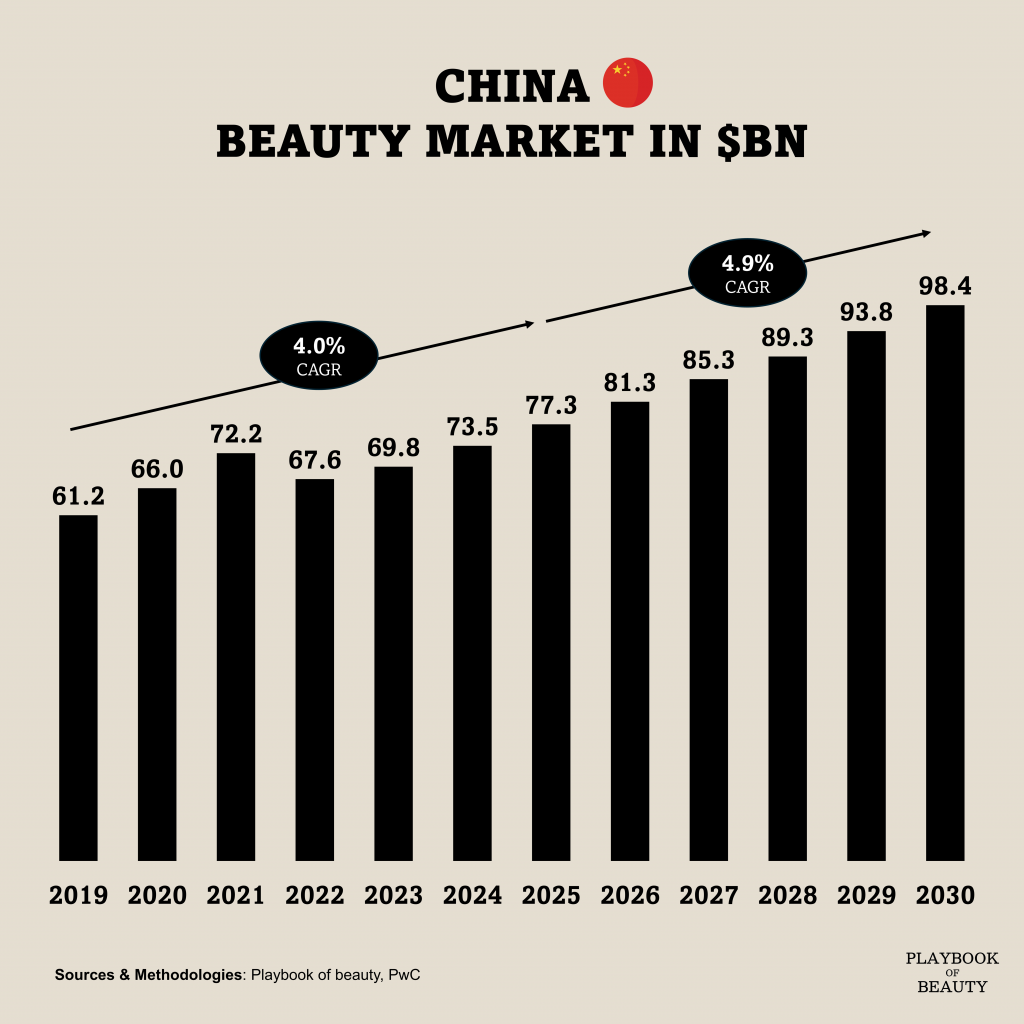

China’s beauty market, only second to the US at an estimated $77.3 billion in 2025 according to PwC, is undergoing a fundamental rebalancing. Its growth now trails the global average (4% CAGR 19-25), signaling not stagnation but a structural internal realignment. The long-standing dynamic where China was a net importer of prestige brands and an exporter of value goods is evolving.

The pandemic was a decisive accelerator. Global brands, hamstrung by logistics, ceded ground. Agile local players like Florasis or Proya seized the moment, not just with speed but with substance, channeling investment into R&D and many new products. This lead to a market polarization. International brands are increasingly relegated to the premium tier, while Chinese names have cemented their dominance in the mass and mid-market segments.

In 2023 Chinese beauty brand sales skyrocketed 21.2%. This came directly at the expense of others: U.S. and European brands saw a slight decline, Japanese brands fell over 26%, and Korean brands, now holding a mere 2.4% market share, dropped 17%.

Driving this shift is a more authoritative consumer. China’s Gen Z shops with a rational, data-driven mindset. Their affinity for domestic “Guochao” trends is less about nationalism and more about informed scrutiny of ingredients, peer reviews, and value a perfect match for local brands’ agile, digital-native playbooks.

There are now two key strategic outlooks for the Chinese beauty market. First, as the domestic market consolidates, leading Chinese companies are looking outward, accelerating overseas expansion and eyeing cross-border acquisitions. Secondly, for global groups operating in China the middle ground has become untenable. A successful path forward demands either an uncompromising focus on luxury authenticity or a genuinely localized strategy that engages the sophisticated, digitally-empowered Chinese consumer on their own terms. The balance of power in beauty in China has subtly, but irrevocably, shifted.