From domestic dominance to international aspirations

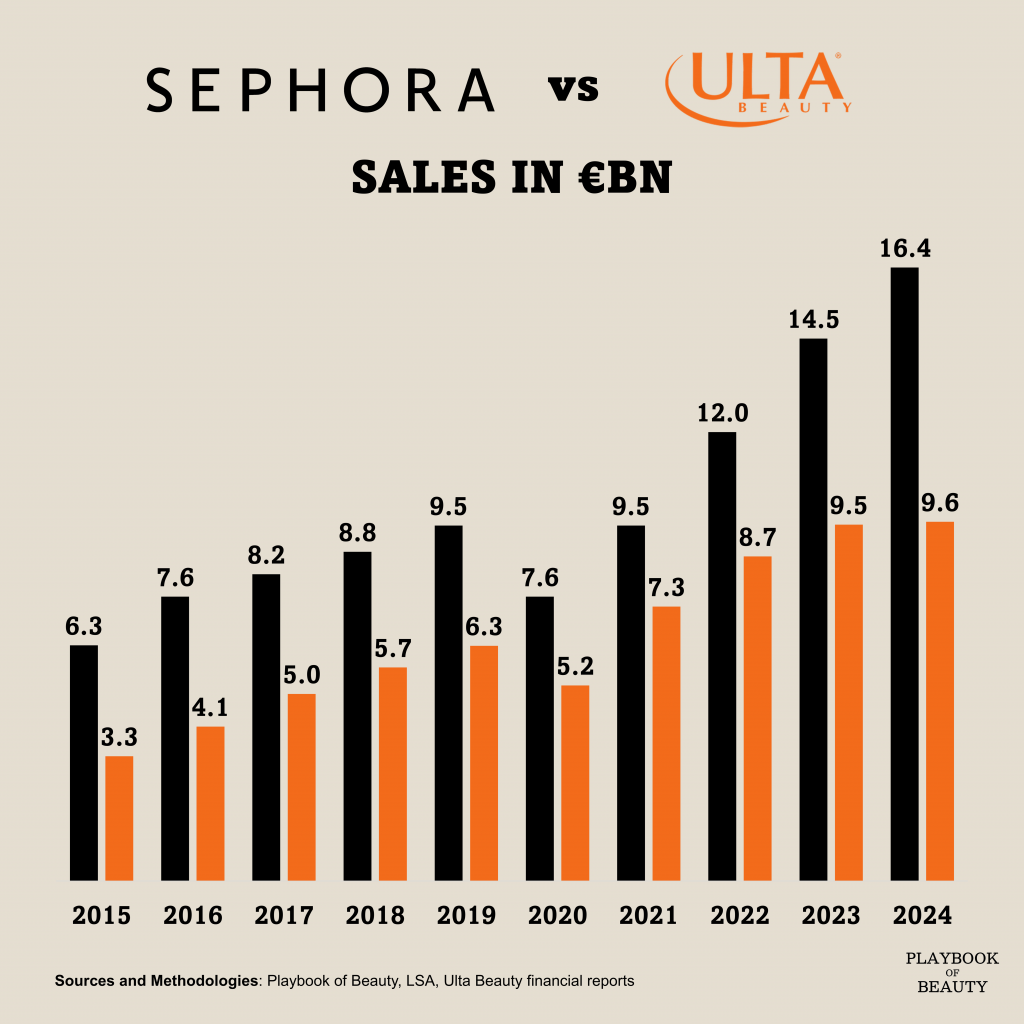

Ulta Beauty’s inaugural store in Mexico City, which opened in August 2025, represents more than a new location but signals a strategic pivot for Ulta. For decades, the American beauty retailer dominated its home market with a unique mass-to-prestige model and a very strong loyalty programme. Yet with 1,445 stores confined to the US, Ulta’s growth ceiling is approaching. Meanwhile, Sephora, its primary rival, operates 2,700 stores across 35 countries and generated €16.4 billion in sales in 2024. Ulta’s revenue stood at €9.6 billion in 2024. The question is whether Ulta can transition from a domestic leader to a global competitor.

A capital-light, partner-driven expansion model

Ulta’s international strategy is both pragmatic and diversified. Rather than a capital-intensive solo expansion, it employs a mixed model: a joint venture with Grupo Axo in Mexico, a franchise agreement with Alshaya Group in the Middle East, and the acquisition of British luxury retailer Space NK. This approach mitigates risk and leverages local expertise. In Mexico, where department stores like El Palacio de Hierro dominate prestige beauty, Ulta’s partnership with Axo provides immediate access to prime real estate and consumer insights. The Middle East, a region where Sephora already operates nearly 90 stores, offers a lucrative but competitive landscape. Alshaya’s established presence will be crucial for navigating complex retail environments.

Ulta’s first store in Mexico

The strategic logic of the Space NK acquisition

The Space NK acquisition is particularly astute. The UK-based chain contributed £196.5 million in sales in 2024 from 83 stores. It offers Ulta an instant foothold in Europe and a laboratory for luxury retailing without diluting its core brand. As GlobalData’s Neil Saunders notes, “Ulta’s headroom for organic expansion in the U.S. is much slimmer than it once was. Space NK unlocks more potential.”

Ulta acquired SpaceNK in July 2025 for an estimated €345m

Differentiation through data and services

Ulta’s differentiation lies in its omnichannel ecosystem and service-led model. Its Ultamate Rewards programme boasts 42 million members, accounting for 95% of sales. This data-rich platform supports UB Media, its retail media network, which personalises marketing and generates high-margin revenue. In-store services—salons, brows, and facials—drive frequency and basket size, an advantage Sephora does not emphasise to the same degree.

Navigating inevitable headwinds

Yet hurdles remain. Ulta will terminate its shop-in-shop partnership with Target in 2026, eliminating a visibility channel that, while contributing less than 1% of sales, broadened its reach. Prestige competition is intensifying globally, and Ulta must secure exclusive brands to rival Sephora’s curated portfolio. Execution risks persist, especially in integrating Space NK and localising assortments.

CEO Kecia Steelman acknowledges that international growth is a “second priority” behind the US business. But with Ulta targeting 4-6% annual revenue growth and low-double-digit EPS growth long-term, global expansion is integral to that vision. The company’s appointment of former Sephora CEO Martin Brok and Amazon veteran Stephenie Landry to its board further signals serious intent.

Playbook of Beauty’s take: a path to more global competition

Ulta may not rival Sephora’s global scale overnight, but its capital-light, partner-driven approach provides a viable pathway. If it can replicate its US success in key markets like Mexico and the UK while leveraging data and services to differentiate, Ulta will emerge as a credible international challenger. The beauty retail wars are entering a new phase.