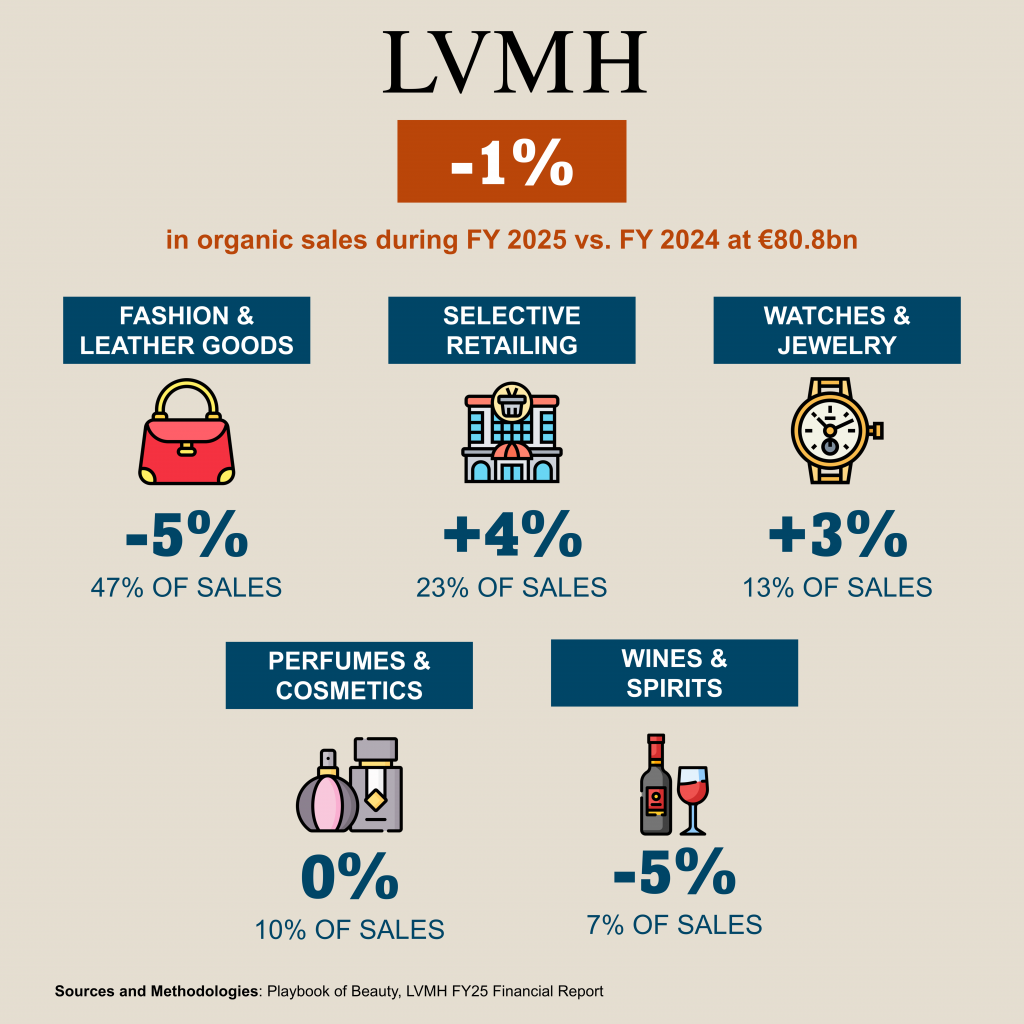

LVMH’s 2025 full-year revenue reached €80.8bn, a reported decline of 5% and a 1% decline at constant rate. Organic revenue growth was a modest 1% in the second half, persisting into the fourth quarter. While profit from recurring operations fell by 9% to €17.8bn, operating free cash flow showed resilience, increasing 8% to €11.3bn.

Douglas’s strategy is focused on a strong omnichannel model where stores drive approximately two-thirds of revenue, effectively leveraged through services like click & collect. Its most significant strategic asset may be its data: its 60 million Beauty Card holders comprise Europe’s largest loyalty program in the sector. This data can be used to refine assortment, pricing, and personalization, focusing on profitable growth rather than pure volume.

The Perfumes & Cosmetics division revenue remained flat on an organic basis at €8.2bn. This stability masks a more positive underlying narrative: profit from recurring operations for the division rose 8%, lifting its operating margin to 8.9%. The results were driven by sustained innovation and a selective retail strategy, with Parfums Christian Dior seeing success from new launches like Miss Dior Essence.

Within the Selective Retailing group, which posted 4% organic growth, Sephora was the clear standout. The beauty retailer continued to achieve solid growth in both revenue and profit, consolidating its global leadership. Sephora gained market share through an enriched brand portfolio, with notably the record-breaking launch of Rhode and by expanding its omnichannel presence with roughly 100 new stores in 2025.

Other divisions presented a mixed picture. Fashion & Leather Goods, while resilient with local customers, saw organic revenue decline 5%, though it maintained a high operating margin of 35%. Watches & Jewelry managed 3% organic growth, aided by Tiffany & Co.’s renovated stores. Conversely, Wines & Spirits faced clear headwinds, with organic revenue down 5% due to weaker demand for cognac in key markets.

The group’s performance underscores a shifting luxury landscape where selective retailing in beauty, exemplified by Sephora, is a robust growth engine. Meanwhile, the core fashion and spirits businesses are navigating post-pandemic normalization and regional demand shifts. LVMH’s confidence for 2026 rests on its brand desirability and cost vigilance, with the trend for the full year appearing cautiously positive, anchored by the return to organic growth in the fourth quarter of 2025.