In the European premium beauty retail market, a strategic contest is unfolding between Douglas, the continental leader and Sephora, the global challenger.

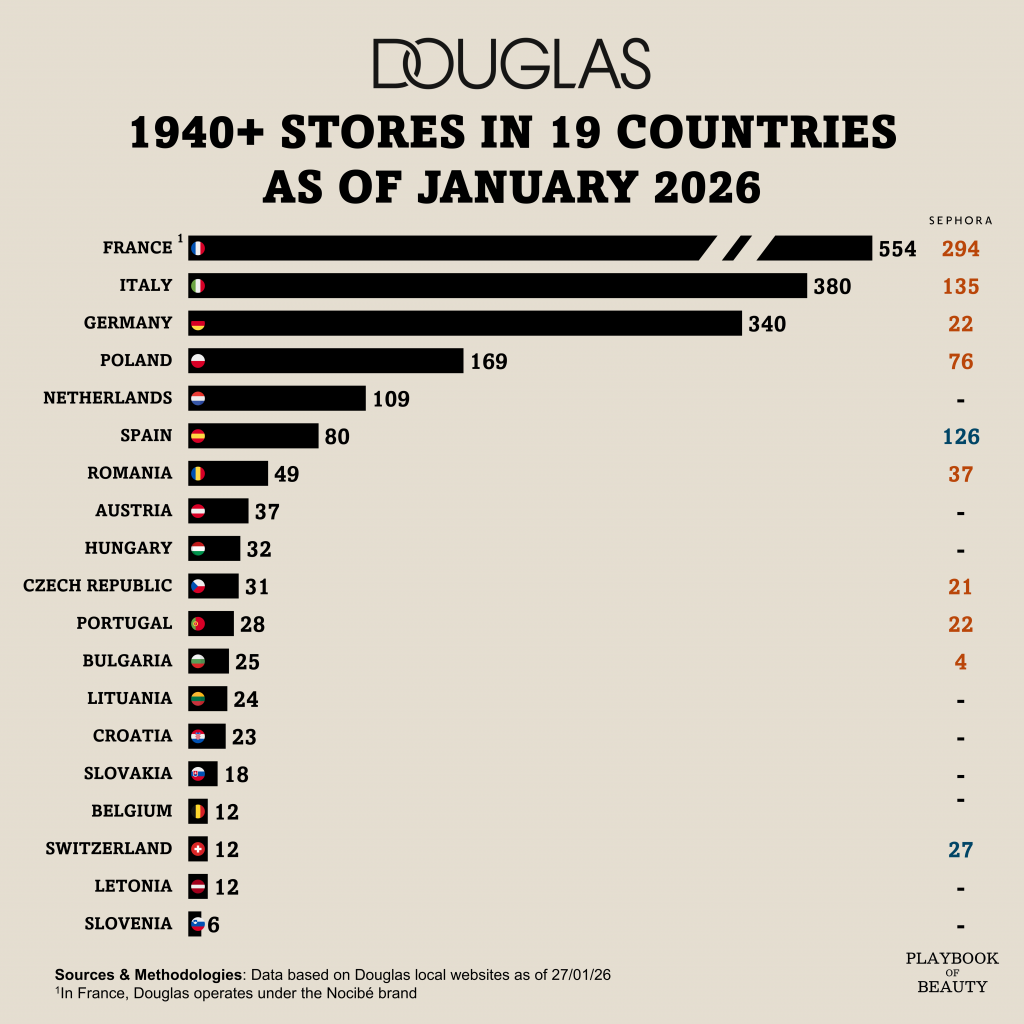

Douglas, with over 1,940 stores across 19 countries, operates a physical network more than twice the size of Sephora’s. This scale, anchored by its Nocibé brand in France (554 stores) and strongholds in Italy (380 stores) and Germany (340 stores), provides a distinct advantage to Douglas. However, scale alone does not guarantee victory.

Douglas’s strategy is focused on a strong omnichannel model where stores drive approximately two-thirds of revenue, effectively leveraged through services like click & collect. Its most significant strategic asset may be its data: its 60 million Beauty Card holders comprise Europe’s largest loyalty program in the sector. This data can be used to refine assortment, pricing, and personalization, focusing on profitable growth rather than pure volume.

The company’s recent IPO on the Frankfurt Stock Exchange marked a pivotal turn, providing capital to deleverage and fund selective expansion. Management is deploying this towards a clear network strategy: opening roughly 200 new points of sale and refurbishing 400 others by 2026, while investing in underlying IT and supply chain capabilities. Recent flagship openings in Antwerp and Paris La Défense signal a focus on high-visibility brand beacons. This expansion is underpinned by solid financial momentum: the group reported €4.58 billion in sales (+3.5%) with a near-doubling of net income last fiscal year, reaffirming moderate growth targets.

Yet, while Douglas commands an estimated 23% market share in continental Europe against Sephora’s 12%, Sephora achieves roughly one-third higher sales per store. This highlights a core challenge: Douglas must elevate the productivity of its vast estate. The in-store proposition diverges strategically between the two retailers: Douglas offers a calmer, service-led experience rooted in fragrance and skincare, whereas Sephora cultivates vibrant, theatrical brand discovery.

The question for Douglas is whether its network density, data assets, and store refurbishment can sufficiently amplify sales per location. Sephora’s ongoing European expansion, including entries into new markets like Belgium, will pressure Douglas in its core regions. Douglas’s next chapter will be written by its ability to turn its scale into superior economic returns.