New data from rAIviews, the leading AI customer reviews analytic solution for the beauty industry, analyzing the most reviewed brands on Sephora’s U.S. website in 2025, provides a proxy for market momentum and consumer engagement. While not a direct measure of sales, review volume offer valuable insights into brand popularity.

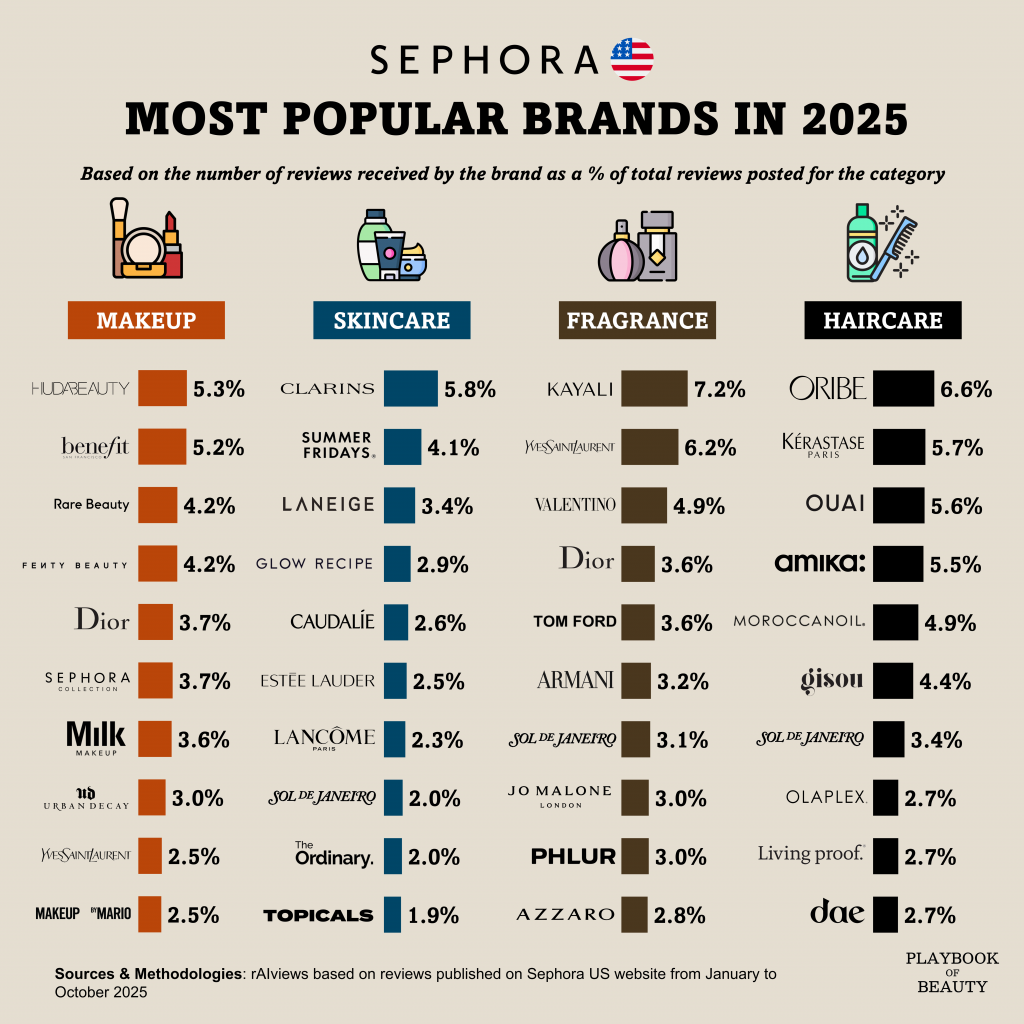

Skincare is notably fragmented, with the top ten brands concentrating less than 30% of total reviews. Clarins (top SKU: Double Serum), Summer Fridays (top SKU: Lip Butter Balm), and LANEIGE (top SKU: Glaze Craze Lip Serum) lead a diverse set where four independents brands coexist with six group-owned brands. Estée Lauder is the most represented group, with both its namesake brand and The Ordinary in the top ten. The category is geographically mixed, led by U.S. (4 brands), French (3 brands), and Korean (2 brands) players.

Makeup demonstrates higher concentration, with the top ten brands capturing 38% of reviews. Huda Beauty (Lip Contour Lip Stain), Benefit (BADgal Bounce Mascara), and Rare Beauty (Soft Pinch Liquid Contour) lead. Group dominance is clear: LVMH holds four brands and L’Oréal two, with almost all top players being French (4) or American (5). It’s the only category where Sephora Collection appears but it has the lowest average score at 3.9 vs. an average of 4.4.

For Fragrance the top ten brands account for 40.6% of reviews. Kayali (CAPRI IN A BOTTLE Lemon Sugar), Yves Saint Laurent (MYSLF Absolu), and Valentino (Born in Roma Donna Extradose) lead. Groups dominate: L’Oréal holds four spots, Estée Lauder two, with L’Occitane and LVMH each holding one. Yet independent brand Kayali claims the top rank.

Finally, haircare shows similar consolidation to fragrance (44.1% share for the top ten), led by Oribé (Gold Lust Night Cream), Kérastase (Nutritive 8H Serum), and Ouai (Super Dry Dry Shampoo). No single group dominates: six groups hold one brand each alongside four independents while American brands command seven of the ten positions. Sol de Janeiro earns special mention as the sole brand ranking in the top ten across three categories: skincare, fragrance, and haircare.

Interestingly the success of sister-founded brands Huda and Kayali reveals a playbook to succeed at Sephora. Huda operates as a vertically integrated creator economy. Its pre-built community of millions de-risks launches and directs concentrated traffic to its anchor partner, Sephora. This creates a cycle where hero products become top sellers, generating massive review volume as consumers validate the dramatic transformations seen on social media. Kayali socializes fragrance by engineering a modular system for layering, encouraging personalized “recipes” that amplify customer conversations.

Ultimately their shared strategy rests on four pillars: founder-led narrative distribution, a focused single retail partnership, products engineered for visible “talkability”, and a culture-and-content synchronicity targeting beauty’s most engaged customers.