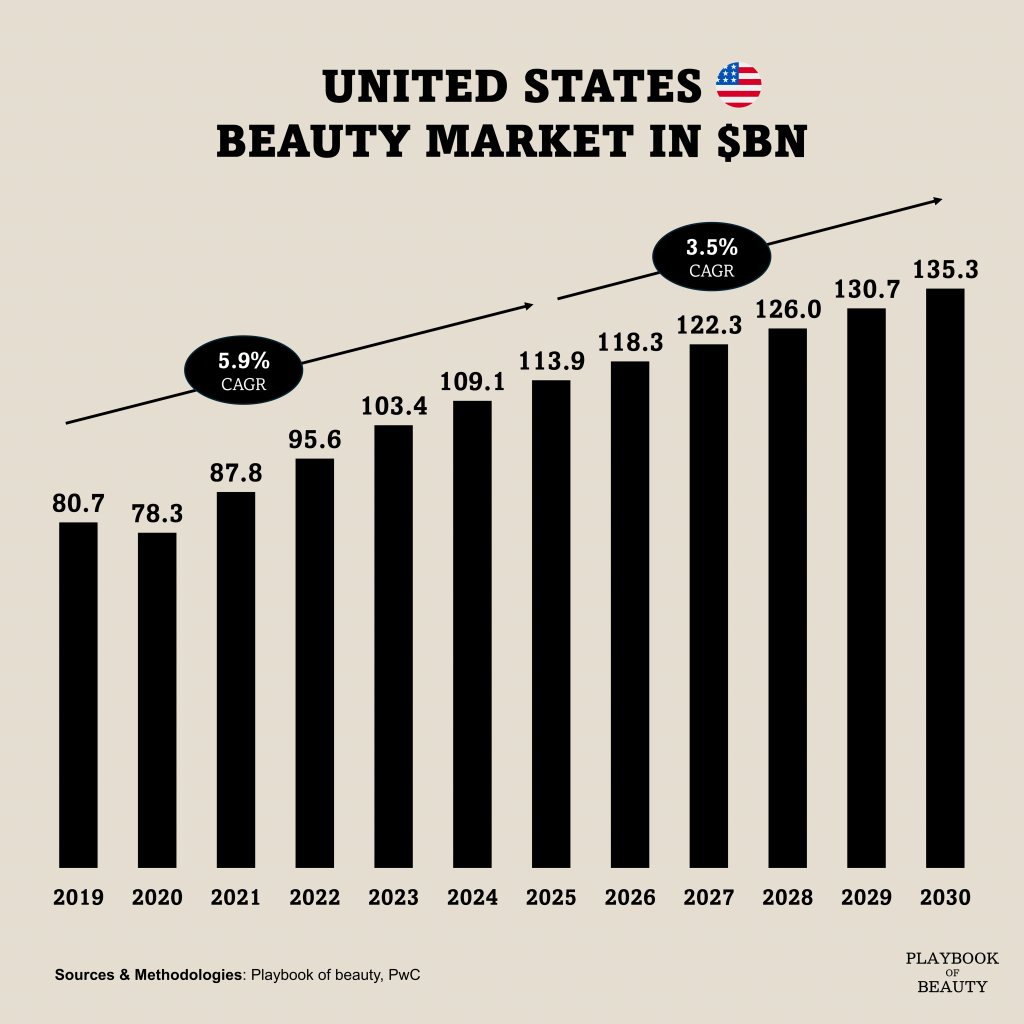

The US beauty market remains the world’s largest, with a projected value of $111.3 billion by 2025. This represents a robust 5.9% CAGR from 2019, outpacing global market growth of 5.3% for the same period. While growth is forecast to slow relative to high-growth regions like India and Southeast Asia post-2025, the market’s strategic importance is only intensifying.

Its core engine is the MZ generation: informed, ingredient-savvy consumers who scrutinize efficacy. This has driven significant demand for dermocosmetic lines and sustained strength in low-to-mid-priced mass brands. The pandemic’s legacy is a mature omni-channel approach, where online efficiency is now balanced by a renewed emphasis on curated offline experiences.

Innovation is unfolding along two key fronts. First, the rigid separation between skincare and color cosmetics is collapsing, giving way to multifunctional hybrids like serum-infused foundations and moisturizing lip tints. Second, the influencer-fueled “dupe” economy is expanding, challenging premium brands with affordable alternatives in color and texture.

For global exporters, the US is a critical beachhead. Imports are growing, and K-Beauty has successfully established it as its largest export market. Notably, Korea now commands over 20% of US color cosmetics imports, the top position among exporting countries. This success is built on strategic consumer targeting, advanced formulations, and product diversity.

Growth in the US continues, but the drivers are fragmenting. Success will belong to brands blending scientific credibility, channel agility, and innovative product forms.