New data from Pattern, the leading e-commerce accelerator, analyzing Amazon Prime Day 2025 search behaviour reveals distinct consumer priorities in the US and UK within beauty.

In the UK, non-branded searches were dominated by core beauty categories. Makeup and skincare accounted for the majority of top searches, with mascara, dry shampoo, and general makeup terms leading. Notably, fragrance did not appear in the top 15.

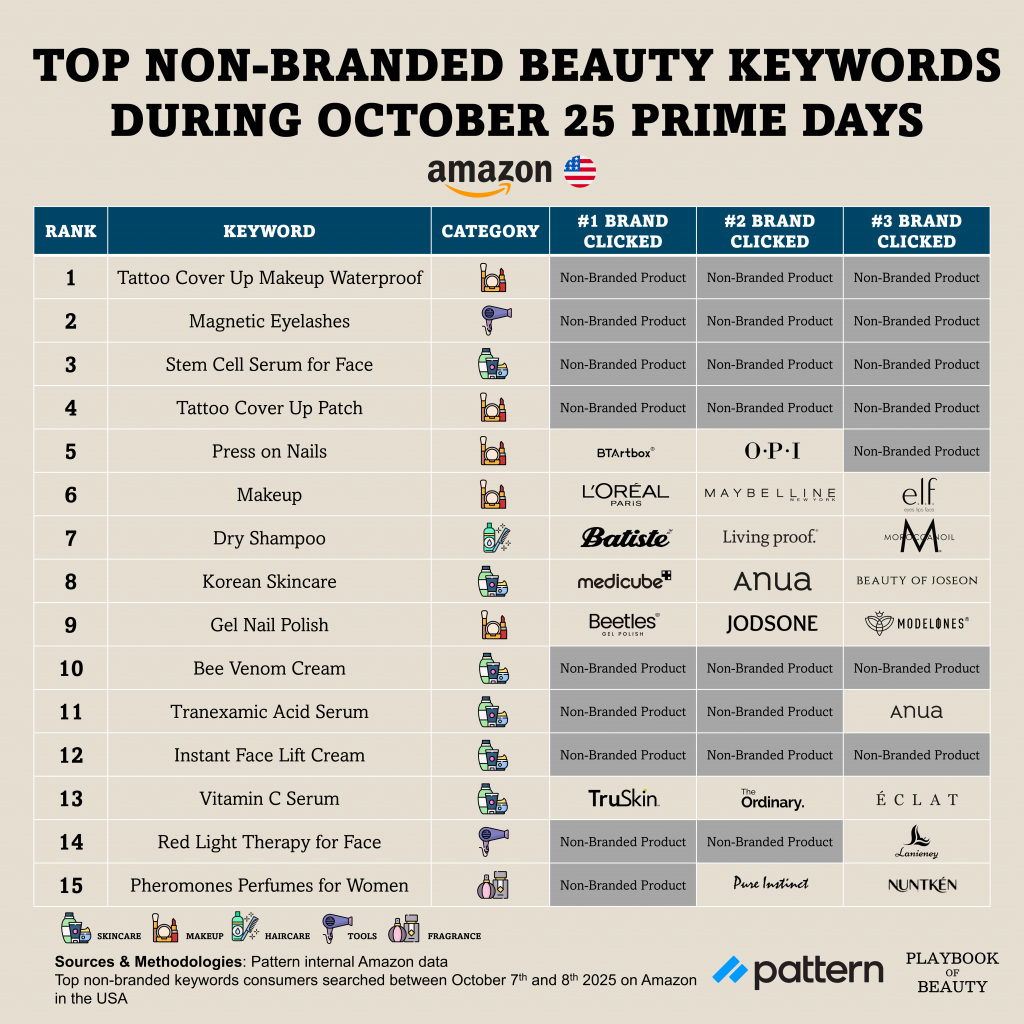

In contrast, US searches displayed greater specificity and emerging trend focus. Terms like “bee venom cream” were common, and “tattoo cover solution” secured two positions in the top five, indicating a strong niche trend. The US list also included searches for tools, accessories, and perfume, categories absent from the UK top rankings.

The divergence extends to brand engagement. Post-click behaviour shows UK consumers favoured brands owned by large groups, which constituted approximately two-thirds of clicks. The US landscape is fragmented: 55% of clicks went to non-branded items, and of the remaining branded clicks, independent labels captured twice the share of large groups compared to the UK.

These patterns suggest UK retailers and brands should prioritize visibility in broad category searches, where competition is often against generic terms. In the US, the opportunity lies in capturing high-intent, specific search queries and leveraging the stronger foothold of independents and private label offerings. The data indicates that cultural trends and product specificity drive US consumer discovery, while UK behaviour remains more category-centric, presenting different challenges for marketing investment and merchandising strategy.