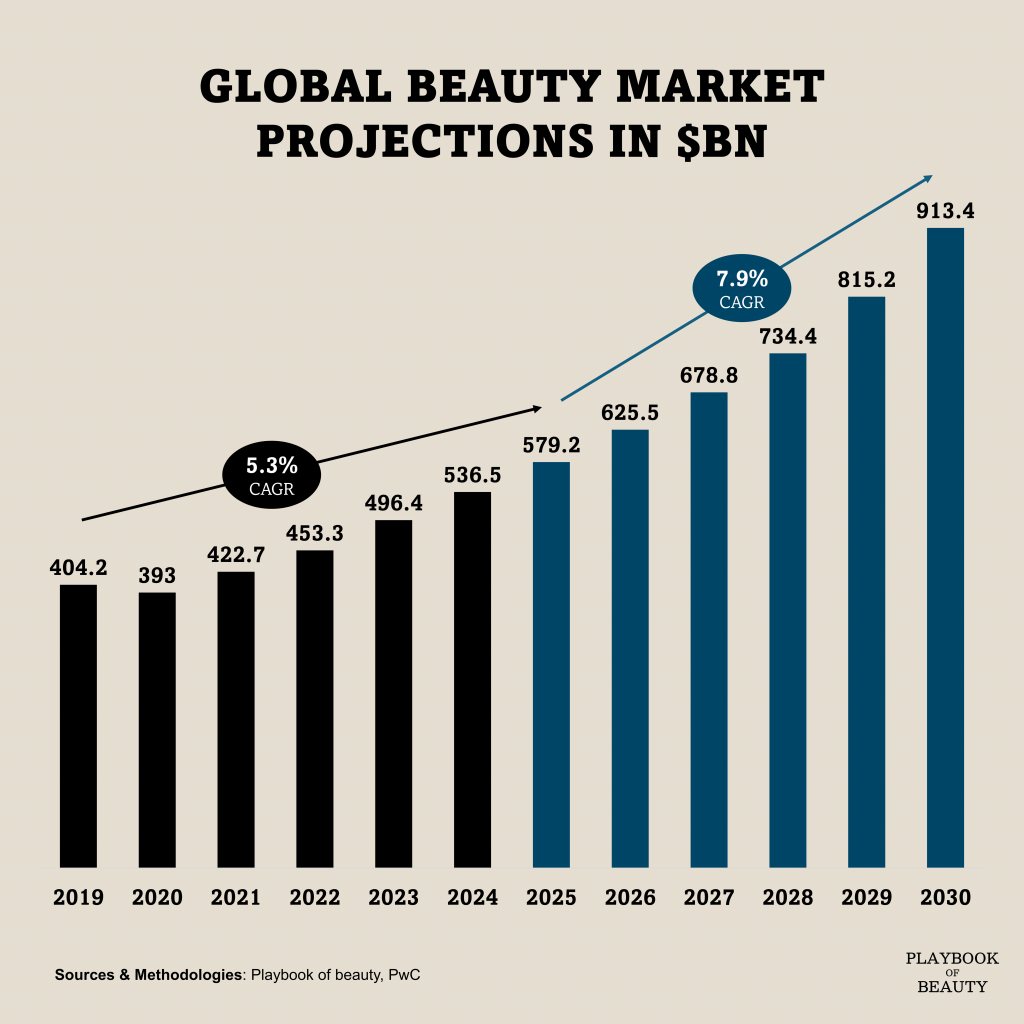

According to PwC the global cosmetics market, valued at $579.2 billion in 2025, is on a trajectory to reach $913.4 billion by 2030. This expansion is not uniform but marks a significant geographic and strategic shift. While North America remains a core market, the most dynamic growth engines are now firmly located in emerging regions.

Consider India, currently the world’s tenth-largest beauty market. With a value of €9.4 billion in 2023, it is projected to grow 10% annually this decade. This surge is supported by a 74% increase in the middle class, reaching 200 million people by 2030, and a strong connectivity with already 10 billion beauty-themed reels played daily. Yet, it remains a market for the patient and strategic, currently dominated by established players like Unilever and L’Oréal.

Similarly, the Gulf’s prestige beauty sector is the fastest-growing globally in 2024, expanding by 12% to $2.6 billion according to data from Chalhoub. While fragrance constitutes half the market, skincare is accelerating at +17%, signaling evolving consumer priorities.

In Latin America, Brazil and Mexico are leading growth. In Mexico half of the population is Millennial or Gen Z, coupled with a 20% rise in female employment over two decades. This is activating the region’s e-commerce, the fifth fastest-growing globally, with retailers like Sephora targeting 100 stores in Mexico by 2030.

Even the established US market, estimated at $114 billion in 2025 by PwC, is undergoing a pivot. Growth is polarizing, with strength at both the accessible entry-point and luxury, while the mid-tier prestige segment faces pressure.

The future of beauty is being written in markets defined by youth, digitally-native consumers, and rising economic confidence. Success will depend less on blanket global strategies and more on precise, localized strategies that resonate with these powerful new consumer cohorts.